HSIL Ltd - Q2 FY11 Result Update

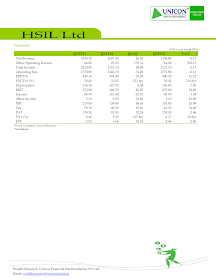

o HSIL Ltd (HSIL)’s total revenue registered a growth of 29% YoY to INR 2220 mn backed by healthy growth in both building products and container glass segments. The results were marginally below our estimates.

o The company’s operating profit at INR 449 mn, witnessed a 20% increase Y-o-Y. EBITDA margin at 20.84% registered a decrease of 121 basis points on a Y-o-Y basis.

o PAT at INR 139 mn witnessed a growth of 52% as compared to the same quarter in the previous year. PAT margin at 6.46% has increased by 107 basis points Y-o-Y. EPS for the quarter stood at INR 2.53.

Valuation

At the CMP of INR 137, the stock trades at ~9x our consolidated FY12E EPS. We recommend to “BUY” the stock with a price objective of ~INR 178.

Thanks & Regards,

Unicon Wealth Research

Nice quarter

ReplyDeletereplica handbags, michael kors outlet online, coach purses, michael kors, nike tn, true religion jeans, new balance, mulberry uk, ray ban pas cher, michael kors outlet online, ralph lauren uk, lululemon canada, hollister pas cher, hogan outlet, nike roshe run uk, nike air force, nike blazer pas cher, kate spade, sac hermes, hollister uk, true religion outlet, nike air max, burberry outlet, nike air max uk, uggs outlet, michael kors outlet, abercrombie and fitch uk, true religion outlet, nike air max uk, north face uk, true religion outlet, polo lacoste, coach outlet, vans pas cher, uggs outlet, michael kors outlet online, sac vanessa bruno, michael kors outlet online, north face, nike free uk, burberry handbags, oakley pas cher, michael kors outlet, michael kors outlet, timberland pas cher, michael kors, converse pas cher, coach outlet store online, ray ban uk

ReplyDeletethomas sabo, moncler uk, pandora jewelry, pandora jewelry, ugg,uggs,uggs canada, ugg uk, juicy couture outlet, canada goose jackets, canada goose, doudoune moncler, canada goose outlet, links of london, louis vuitton, moncler outlet, juicy couture outlet, moncler, louis vuitton, pandora uk, swarovski crystal, louis vuitton, marc jacobs, ugg pas cher, moncler, replica watches, moncler, toms shoes, montre pas cher, wedding dresses, hollister, louis vuitton, canada goose, canada goose outlet, supra shoes, coach outlet, louis vuitton, pandora charms, canada goose uk, canada goose, canada goose outlet, moncler, swarovski, karen millen uk, ugg, ugg,ugg australia,ugg italia, moncler outlet

ReplyDeletenike shoes

ReplyDeletecanada goose

hermes

coach outlet online

hermes handbags

christian louboutin

off white hoodie

coach outlet

off white hoodie

yeezy

look at this website go to this website you can find out more Get More Information news dolabuy.co

ReplyDeleteblog link h7o03j1p42 louis vuitton replica handbags replica bags china v5g88f2q12 hop over to this website n5p82j0z58 high replica bags replica bags manila you could try here k7v52z7p04 louis vuitton replica joy replica bags review k8k73a5e37

ReplyDelete